The logistics landscape between the United States and Mexico is dynamic, shaped by trade agreements, shifting political conditions, and—most importantly—tariffs. For logistics managers running cross-border operations, the goal is clear: stay compliant while protecting cost efficiency. In practice, the difference between smooth freight flow and costly delays often comes down to one thing—strong tariff expertise. In other words, tariff changes don’t just affect paperwork—they directly impact landed cost and delivery timelines.

The current trade relationship, primarily governed by the United States–Mexico–Canada Agreement (USMCA), offers significant advantages, yet specific tariffs and duties remain for various goods. These can change rapidly due to trade disputes, anti-dumping measures, or shifts in international policy, creating a continuous need for vigilance. This complexity makes the role of the customs and freight broker indispensable for any logistics manager looking to secure an advantage.

The Indispensable Role of the Freight Broker

In the complex ecosystem of US-Mexico logistics, Go To Truckers freight brokers are more than just a service provider; they are a critical partner and an extension of your compliance team. Their value is magnified when dealing with the intricacies of tariffs and cross-border regulations.

A knowledgeable broker serves as your primary defense against compliance risks and unforeseen costs.

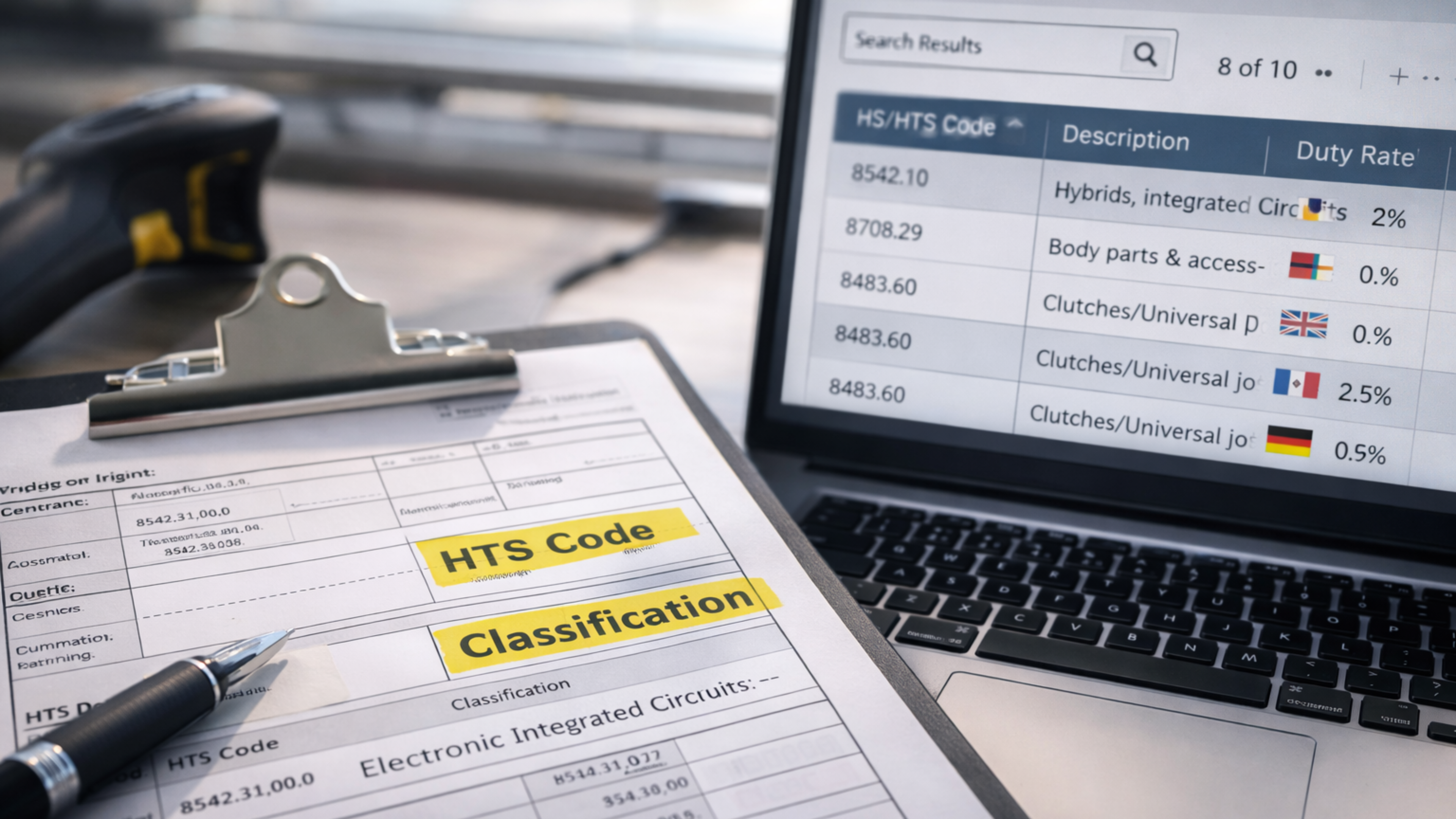

1. Expertise in Tariff Classification and Calculation

The foundation of tariff compliance is accurate classification. Goods must be assigned the correct Harmonized Tariff Schedule (HTS) code. Misclassification, whether accidental or intentional, can lead to severe penalties, delays, or the payment of incorrect duties.

Go To Truckers freight brokers maintain up-to-date knowledge of the US and Mexican tariff schedules, including the specifics of the Ley de los Impuestos Generales de Importación y de Exportación (LIGIE) in Mexico. They specialize in determining the precise HTS code, calculating applicable duties, and ensuring that all necessary documentation aligns with the declared classification.

2. Navigating USMCA Rules of Origin

The USMCA provides preferential treatment, often zero tariffs, for goods that meet specific Rules of Origin criteria. Determining whether a product qualifies for USMCA benefits is highly technical, involving tracking the regional value content, specific processes, and the origin of materials.

Logistics managers should rely on their freight broker to perform the necessary due diligence. Go To Truckers brokers facilitate the preparation of the Certificate of Origin and verify that the production records fully support the claim. Failure to correctly manage this can result in the loss of preferential tariff rates, significantly impacting the landed cost of goods.

3. Mitigating Compliance Risk and Penalties

Border agencies on both sides, such as US Customs and Border Protection (CBP) and the Mexican National Customs Agency (ANAM), are rigorous in their enforcement. Errors in paperwork, valuation, or classification can result in goods being held, subject to inspection, or incurring substantial fines.

The broker’s role is to act as a proactive risk mitigator. Go To Truckers brokers manage the submission of electronic documentation, ensure timely payment of duties, and structure the customs process to withstand regulatory scrutiny. They also provide consultation on compliance programs, such as USMCA post-importation audits.

Key Actions for Logistics Managers

To maximize efficiency and minimize tariff-related costs, logistics managers should treat their broker relationship as a strategic partnership.

| Action Item | Description | Broker’s Role |

| Regular Audits | Review HTS codes and duties paid on high-volume products at least semi-annually. | Provides current tariff codes and identifies potential cost-saving exemptions. |

| Documentation Integrity | Ensure all commercial invoices, packing lists, and certificates of origin are accurate. | Verifies all documents for compliance before submission to customs. |

| Origin Verification | Conduct due diligence on suppliers’ claims regarding USMCA eligibility. | Assists in obtaining and filing proper documentation, such as the USMCA Certification of Origin. |

| Stay Informed | Track changes in trade policy, especially new anti-dumping or countervailing duties. | Provides real-time updates and advisory services on new regulations and tariffs. |

So what does “tariff expertise” look like in real operations—when deadlines are tight, rules shift, and landed cost matters? This is exactly where the broker relationship stops being transactional and starts becoming a real competitive advantage.

In this environment, partnership is key to success. Logistics managers who treat their freight broker as a strategic asset—and leverage their specialized knowledge of US–Mexico tariffs and customs law—can strengthen compliance, reduce disruptions, and protect margins in one of the world’s most critical trade corridors. For guidance on specific tariff structures and lane-level planning, connect with your Go To Truckers broker or reach out through our contact information on our web site.

No Comments yet!